What You Have to Know

- The S&P 500 fell for the primary time in 10 weeks, snapping the longest streak of positive factors in nearly 20 years.

- Within the inventory market, the pullback adopted a flurry of shopping for that had sat uneasily with Wall Avenue contrarians.

- Seen by means of the lens of positioning, the image arguably stays bearish.

This isn’t how Wall Avenue hoped to ring in 2024.

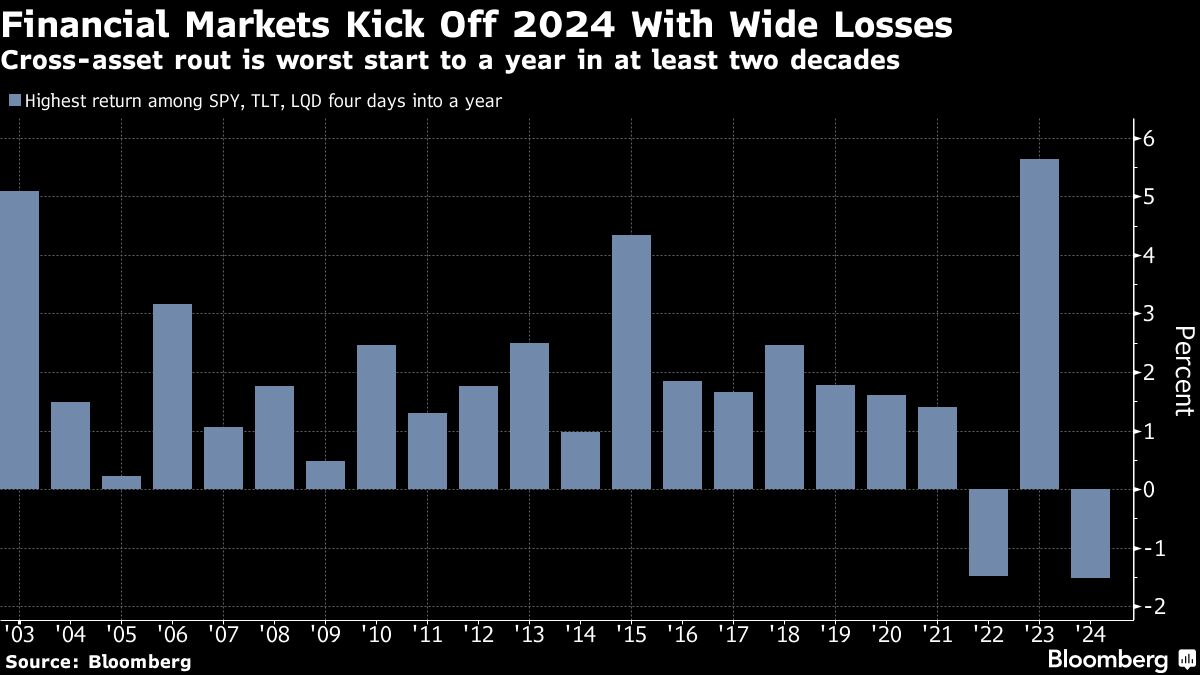

Loaded up and bullish after a spirited vacation rally, traders have been smacked with previous worries within the new 12 months, amongst them recent questions in regards to the path of Federal Reserve coverage. The consequence: a cross-asset drubbing that surpassed any to start out a 12 months in at the very least twenty years.

The S&P 500 fell for the primary time in 10 weeks, snapping the longest streak of positive factors in nearly 20 years. Treasuries and company credit score dropped probably the most since October.

For merchants primed for interest-rate cuts in March, a hotter-than-forecast jobs report doubtlessly blurred the outlook additional on Friday. However the seeds of disillusionment have been sown weeks earlier than, when traders shed bearish wagers and dived into dangerous property of all stripes.

With the pool of latest consumers operating low, bulls have been left to cope with a nagging sense they’d taken December’s euphoria too far.

To make sure, not a lot could be gleaned from a couple of days’ buying and selling in terms of how the 12 months will unfold, historical past reveals. Nonetheless, the swings have been one more reminder of the hazards of overconfidence when plotting the outlook for rate-sensitive methods, particularly after a 12 months wherein Wall Avenue efforts to foretell market strikes led to distress.

“Buyers have been getting complacent and anticipating a hat trick of fading inflation, steady job progress, and earnings up and to the fitting,” stated Michael Bailey, director of analysis at FBB Capital Companions. “This week has muzzled a number of the bulls.”

In a reversal from the all the things rally within the ultimate months of 2023, all main asset courses fell within the holiday-shortened week. Extensively adopted exchange-traded funds monitoring equities and stuck revenue declined at the very least 1.5% over the primary 4 classes, the worst pan-markets hunch to start out a 12 months because the two well-liked bond ETFs have been created in mid-2002.

Present Headwinds

Although headwinds similar to Apple Inc. downgrades and heavy company issuance weighed on markets, complacent investor positioning significantly round central-bank coverage was the important thing accelerant. In mounted revenue, merchants had seen a Fed rate of interest reduce in March as a positive guess in late December.

Now, the implied likelihood has been pared to round 70% or so. For all of 2024, swaps level to a complete of 137 foundation factors of price cuts, versus about 160 foundation factors final Wednesday. A lot the identical sample performed out in Europe.

The repricing drove 10-year Treasury yields again to 4%, retracing greater than half of the decline since Dec. 13 when Fed Chair Jerome Powell laid the groundwork for financial easing later this 12 months. It’s straightforward to level finger on the lopsided positioning.

A JPMorgan Chase & Co.’s survey confirmed its shoppers’ web lengthy positions within the Treasuries market surged towards the very best since 2010 in November, earlier than being step by step trimmed down since then.

“Individuals wished to leap on what’s seen as a sea change, transfer from charges not going up,” stated Alan Ruskin, chief worldwide strategist at Deutsche Financial institution AG, on Bloomberg TV. “I believe that made sense, however then the market simply received forward of itself. Now, we’re in retreat.”

Within the inventory market, the pullback adopted a flurry of shopping for that had sat uneasily with Wall Avenue contrarians. Combination inflows into U.S. fairness ETFs reached 0.18% of whole market capitalization on a four-week whole foundation, the very best stage in seven years, information compiled by Ned Davis Analysis present.

S&P 500 vs ETF flows. Supply: Ned Davis Analysis

S&P 500 vs ETF flows. Supply: Ned Davis AnalysisHedge funds, which resisted chasing positive factors in November, gave in final month, with their web flows turning “meaningfully optimistic,” in response to prime-broker information compiled by JPMorgan. Whereas the broad publicity has but to achieve excessive ranges, the swift bullish pivot sparked warning among the many workforce led by John Schlegel.

Of explicit concern was the tempo at which fund shoppers unwound their bearish wagers. The quantity of quick masking since late October was bigger than any interval since 2018, apart from the pandemic rebound in March 2020.