How the P&C market is trying to form up all through this burgeoning 12 months

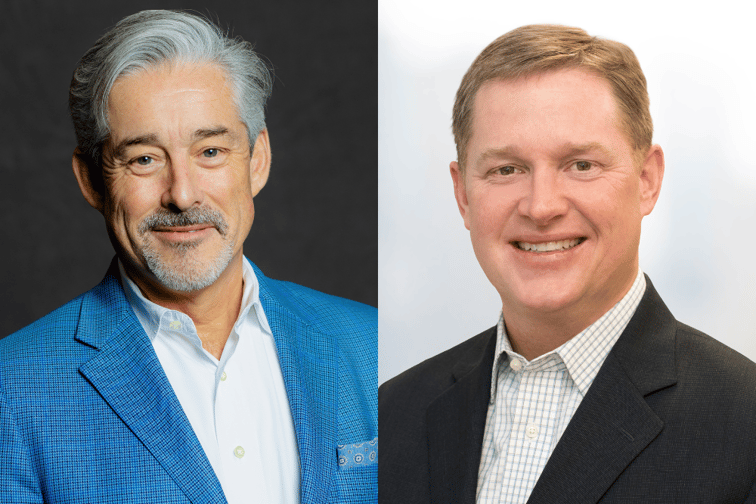

The constraints, challenges and exposures that continued all through the P&C market in 2023 won’t be going wherever in 2024, in response to Amwins’ government vp, nationwide property observe chief Harry Tucker, and Thomas Dillon, the corporate’s government vp – nationwide casualty observe chief.

“The closely cat uncovered properties are going to be stay an issue, whereas any adversely affected enterprise in any approach, goes to be the goes to be the hardest problem for us,” Tucker stated.

“Within the casualty house, auto continues to be an space issue from a profitability perspective for carriers each inside the main and the surplus house. It isn’t simply trucking firms, it’s gross sales fleets, development fleets and emergency medical,” Dillon added.

Whereas a major market softening is just not anticipated to happen in 2024, each Tucker and Dillon imagine that there’s additionally an opportunity for carriers to faucet into alternatives by way of specialization in unsure instances.

“The areas of dislocation, the place the market is both going up or down, are additionally areas of alternative,” the previous stated.

“We’re extremely targeted on the cat-driven troublesome property dangers — that’s our forte.”

On the casualty facet, Dillon is noticing that continued uncertainty in the usual markets can be going to supply extra alternative for the E&S house in 2024.

“You are seeing dangers which have moved from the E&S house into the into the usual house that aren’t prepared to return again primarily based on efficiency, primarily based on the efficiency of an trade phase or on an account-by-account foundation,” he stated.

Elsewhere, Tucker believes that progress and sidestepping market constraints is thru insurance coverage professionals in search of continued specialization when coping with troublesome accounts.

“Alternative going into the long run shall be discovered within the continued funding in specialization and experience in particular markets and industries,” he stated.

In an interview with Insurance coverage Enterprise, Dillon spoke about why the center market house would be the best in 2024 whereas each spoke about why tort reform could also be harder to pursue.

The “Cadillac” of merchandise

Inside the Amwins state of the marketplace for 2024 report that was launched final month, center market enterprise, particularly insureds with premiums between $10,000 to $100,000, remained essentially the most pursued class of enterprise since carriers discover it extra worthwhile total.

Dillon anticipated that this can proceed to be the case in 2024, ensuing within the phase changing into extra aggressive all year long.

“Within the casualty house, insurance coverage firms have traditionally carried out higher from a loss perspective on small center market enterprise,” he stated.

“It is also a lot stickier enterprise. When you have a $30,000 account, you get 10% enhance, that’s $3000. It does not transfer from service to service as regularly because the because the bigger enterprise does. If a service loses cash in a single 12 months, they know they’ve a pair years down the street to make it worthwhile, as a result of the enterprise will principally seemingly stick with them, versus bounce ship and go to a different service.”

It is a results of enterprise being extra effectively dealt with by insurance coverage professionals, which Dillon expects to extend within the coming months attributable to extra technological capabilities being launched and refined.

“With using AI and expertise, you may quote issues faster,” he stated.

Nevertheless, Dillon predicts that there shall be extra concerted efforts to extend the capabilities of this phase to make carriers much more aggressive.

“They’re creating groups and applied sciences inside their underwriting group, simply to deal with that enterprise,” he stated.

“They’re getting the Cadillac of merchandise which have effectivity, quickness and truthful pricing in thoughts.”

Why tort reform could also be troublesome to realize

Elsewhere, as litigation funding and social inflation turns into extra widespread, insurance coverage professionals like Tucker and Dillon hoped that extra authorities motion shall be taken to curb this widespread phenomenon.

“Hedge funds are aggressively going after that enterprise proper now. It is good cash,” Tucker stated.

“On the floor, it seems as if it is benefiting the patron and the plaintiff. But it surely’s type of a dichotomy or a paradox that these attorneys are saying, ‘we’re going after the large unhealthy insurance coverage firm, we wish the large cash,’ when it is truly massive cash that’s funding these items.”

Nevertheless, Dillon has famous that states have been noticing how these organizations and their ways are affecting the judicial system.

“The extra states that are available in and possibly not alleviate or restrict it, however no less than expose this observe shall be very useful,” he stated. “We will hope that from the entrance finish, least, there isn’t any Wizard of Oz behind the scenes, that is pulling all of the strings that to offer people the flexibility to deliver frivolous lawsuits into the system.”

Dillon factors to the latest passing of Florida’s Home Invoice 837, which is supposed to assist curb frivolous lawsuits, as a step in the precise route.

“But it surely takes some time for these items to work their approach down the system,” he stated.

“Nevertheless, due to our political and election system, there could also be an entire new legislator in workplace in three to 5 years as soon as we start to witness the true impacts of those reforms.”

Moreover, plaintiff lawyer political PACs even have plenty of energy, with the flexibility to affect federal laws.

“It’s very troublesome for tort reform to cross as a result of the plaintiff’s lawyer bar is such a robust foyer pack in Washington. It must be accomplished on a sate-by-state foundation,” Dillon stated.

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing checklist, it’s free!