[ad_1]

A prime query readers ask is, “How do I monitor my insurance coverage declare with Allstate?” Simply monitor the progress of your Allstate auto insurance coverage declare by going to Allstate’s web site, downloading the cell app, calling an Allstate consultant, or establishing electronic mail and textual content alerts.

Staying up-to-date in your Allstate claims standing can considerably velocity up your settlement, and the corporate affords handy instruments to assist.

Our complete information solutions questions resembling, “Does Allstate pay claims correctly?” and explains the Allstate claims course of. In case your charges went up after an Allstate declare, enter your ZIP code into our free quote instrument above to match charges from the highest suppliers in your space.

The right way to Observe the Progress of Your Allstate Auto Insurance coverage Declare

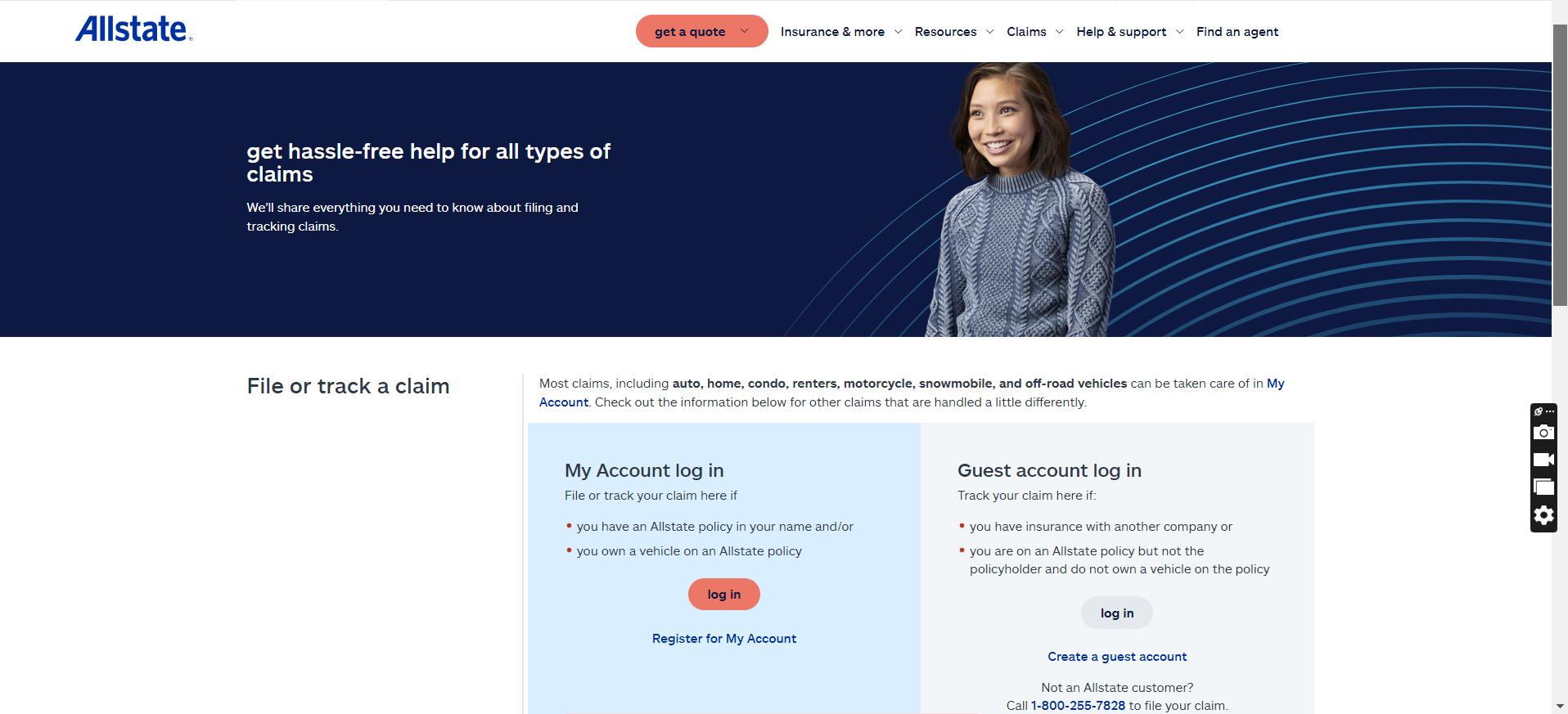

Step #1: Go to Allstate’s Web site

Like many different firms, Allstate permits you to each file and monitor your auto insurance coverage declare via a web-based portal at any time, which you’ll want an account to do. Many individuals select to arrange a web-based account once they begin their full protection insurance coverage or once they need to file a declare.

As soon as logged in, navigate to the “Claims” part to see present claims statuses, required douments, and subsequent steps within the course of. Maintain your Allstate claims login safe and accessible at any time when it is advisable monitor your declare, handle your insurance coverage coverage, or get a brand new ID card.

Evaluate over 200 auto insurance coverage firms directly!

Secured with SHA-256 Encryption

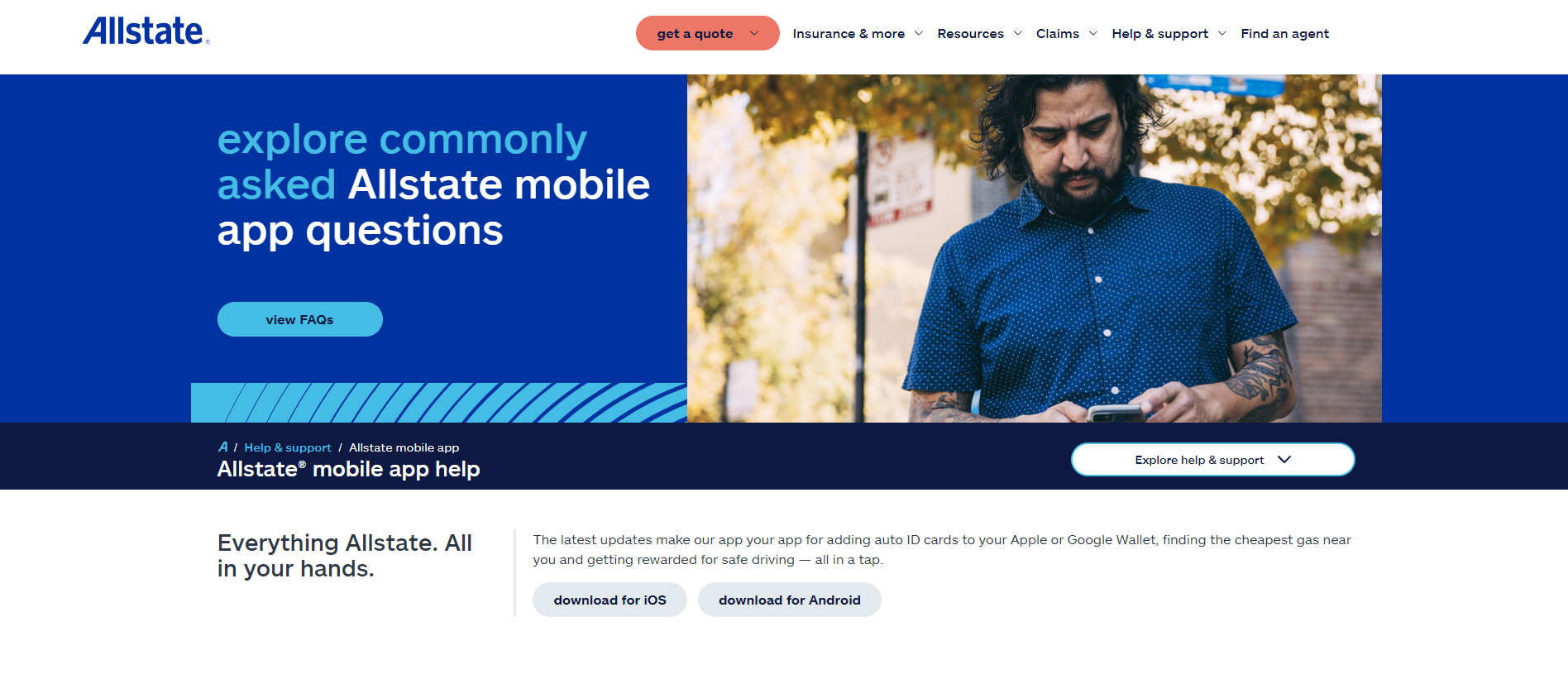

Step #2: Attempt the Cell App

One other handy useful resource for monitoring Allstate claims is the corporate’s cell app. You may also conveniently add mandatory documentation, images, or related claims info out of your cellphone.

Having real-time entry to your Allstate declare with the cell app is an effective way to remain up-to-date and get a fast decision. You may also pay your Allstate insurance coverage premiums and entry your ID card within the app.

Discover out extra by studying: “How do auto insurance coverage firms pay out claims?”

The Allstate cell app has 4.8 out of 5 stars on the Apple App Retailer with nearly 1,000,000 evaluations, whereas the Google Play Retailer offers the app a 3.9 out of 5 stars with over 100,000 evaluations.

Step #3: Name Allstate

Allstate policyholders can even name the Allstate claims cellphone quantity 24 hours a day, 7 days per week, at 1-800-255-7828. Your Allstate auto insurance coverage adjuster can provide personalised updates and extra perception into how your declare goes, and even show you how to higher perceive how auto insurance coverage works.

By speaking with Allstate consistently, you possibly can obtain updates, ask for clarification, and expedite the claims course of by responding rapidly to requests for paperwork or extra info.

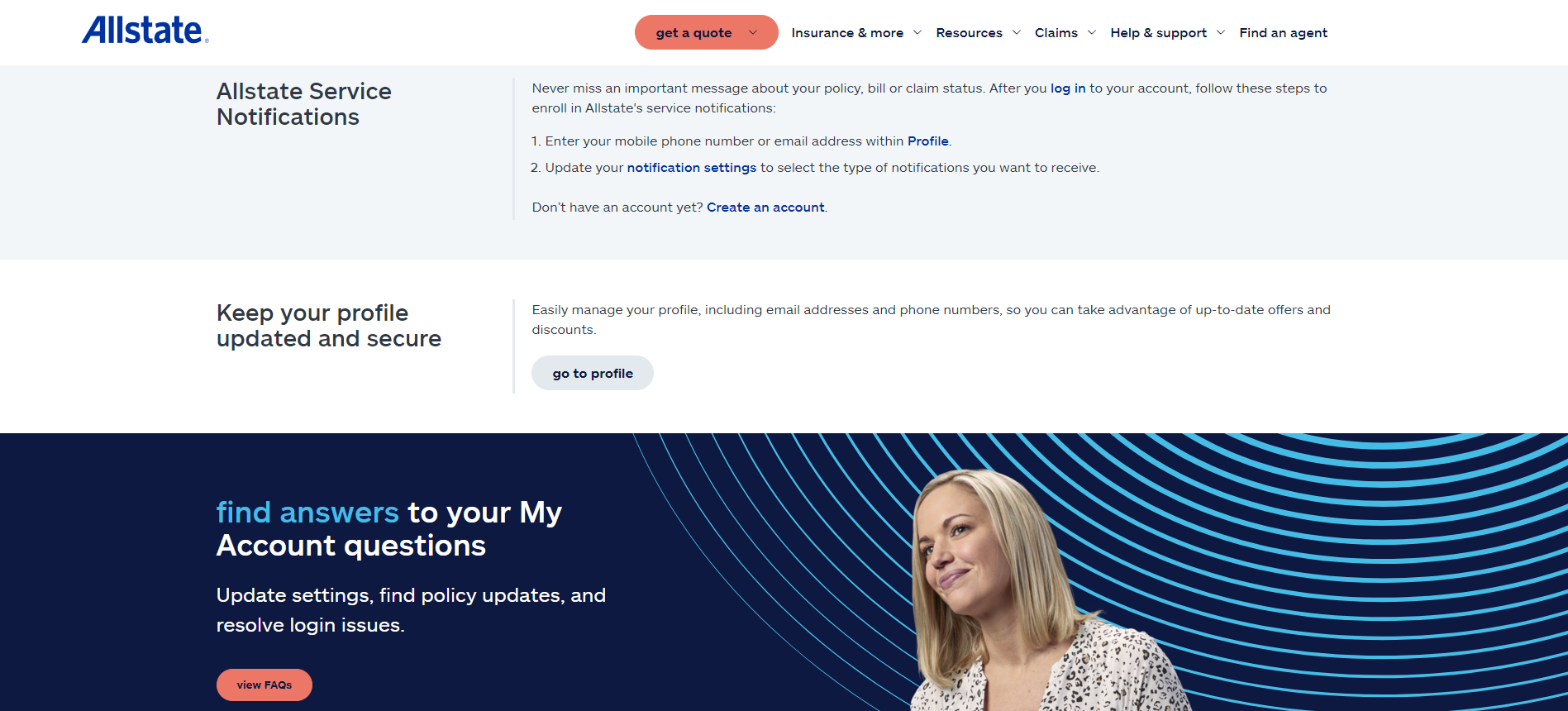

Step #4: Get Declare Alerts

Most of the greatest auto insurance coverage firms, together with Allstate, provide straightforward methods for drivers to obtain real-time updates by textual content message or electronic mail. To arrange notifications, go to your Allstate account or the cell app.

Attending to-the-minute alerts in your claims standing is important to make sure you don’t miss vital developments or requests for added info. Maintain your contact info up to date consistently so you possibly can obtain handy alerts from Allstate in your sensible cellphone.

Evaluate over 200 auto insurance coverage firms directly!

Secured with SHA-256 Encryption

How Allstate Handles an Auto Insurance coverage Declare

When you notify the corporate a few declare, adjusters will collect details about the injury to your car. In some circumstances, you could possibly submit that info digitally, as the corporate has a “QuickFoto” declare possibility. You possibly can take images of the car injury and add them to your on-line account and the corporate will use them to estimate restore prices.

Be taught Extra: The right way to File an Auto Insurance coverage Declare

Many readers have requested, “How lengthy does it usually take for Allstate to course of an auto insurance coverage declare?

Whilst you can count on Allstate to resolve your declare inside 16 days usually, it will depend on many components, resembling accident severity and claims complexity.

Tim Bain

Licensed Insurance coverage Agent

Evaluate the common claims decision time for Allstate vs. prime opponents right here:

Ought to the car have vital injury, Allstate could ask you to take it to a restore store that’s a part of their acknowledged community. A technician will examine the injury and ship a report back to Allstate. The corporate will use this info to give you an estimate.

You Will Must Ship Allstate Sure Info Earlier than They Can Efficiently Course of Your Declare

Allstate could require contact info for anybody concerned within the accident and their insurance coverage particulars. As well as, you need to inform them the place and when the accident occurred and provides them the identification names or numbers of any responding officers, with a replica of the police report if they supply one. Discover out extra in regards to the query: “Do it is advisable file a police report after an accident?”

It’s a good suggestion to offer any vital info promptly, as this may assist Allstate to course of your declare as rapidly as potential.

Allstate Will Notify You As soon as Completed Reviewing Your Declare

Allstate will contact you on to request any extra info in the event that they want it, however in any other case, you’ll get an estimate as soon as Allstate finishes its assessment. Then, you possibly can then schedule the restore work at a store of your selection. Normally, Allstate pays the store instantly, or they could typically ship you the cash to cowl the declare.

Keep in mind, you’ll often need to take your deductible into consideration. As well as, submitting a automobile insurance coverage declare with Allstate will often end in greater charges when your coverage renews.

As you possibly can see, Allstate auto claims may cause the value of automobile insurance coverage to extend by round 41%, however the quantity it goes up additionally will depend on components resembling fault and accident severity. Be taught how your driving report impacts auto insurance coverage charges right here.

Evaluate over 200 auto insurance coverage firms directly!

Secured with SHA-256 Encryption

You Can Observe Your Auto Insurance coverage Declare With Allstate

You possibly can monitor the progress of your auto insurance coverage declare with Allstate by logging into your account and checking the standing. You will have a web-based account to service your coverage, file a declare, and monitor its progress.

7 issues which will issue right into a automobile insurance coverage premium: https://t.co/l88FIA752R pic.twitter.com/WXaWRImq3X

— Allstate (@Allstate) July 27, 2017

Keep in mind to ship the corporate full particulars in regards to the accident to allow them to deal with the declare as promptly as potential. Enter your ZIP code into our free quote comparability instrument beneath to immediately store for costs from essentially the most inexpensive auto insurance coverage suppliers.

Continuously Requested Questions

How do I monitor the progress of my Allstate auto insurance coverage declare?

You possibly can monitor your Allstate automobile insurance coverage declare by visiting the cell app, web site, calling your agent, or getting alerts. When calling your agent, the Allstate insurance coverage cellphone quantity for auto claims is 1-800-255-7828. Uncover extra methods to handle your coverage in our assessment of Allstate auto insurance coverage.

How do I file a declare towards an Allstate driver?

Allstate third-party claims are what you file if a driver with Allstate insurance coverage causes an accident that damages your car.

When does Allstate think about a automobile totaled?

What ought to I do when the opposite driver doesn’t have insurance coverage?

You possibly can file a declare with your personal insurance coverage firm when you have uninsured motorist protection in your coverage. Discover out extra about what occurs in the event you hit an uninsured driver.

Does Allstate pay claims correctly?

You is likely to be questioning, “Is Allstate good about paying claims?” Whereas Allstate’s claims satisfaction has improved through the years, a 2023 J.D. Energy discovered the corporate scored barely decrease than the trade common of 878 out of 1,000 factors.

How lengthy does Allstate take to answer a declare?

After you file a automobile insurance coverage declare, you possibly can count on to get a name from Allstate inside a pair days, however it will probably take round 16 days for the corporate to settle your declare.

What number of claims earlier than Allstate drops you?

Whereas there’s no certain amount of claims that causes an insurer to drop you, Allstate can select to drop you at any time in the event you file too many claims.

How lengthy does it take to get cost from Allstate?

After your declare will get accredited, you possibly can typically count on your payout to course of inside just a few days.

How does Allstate calculate ache and struggling?

Like many different insurers, Allstate makes use of the multipler methodology to find out the way it pays out for damages after accidents. The multiplier methodology takes the price of precise damages and multiplies it by a quantity between 1.5 and 5.

How do you negotiate a settlement with Allstate?

What’s the Allstate claims cellphone quantity in California?

The CA claims cellphone quantity for Allstate is similar for all Allstate policyholders, which is 1-800-255-7828.

Does Allstate elevate charges after your first accident?

Allstate, and most different firms, will elevate your automobile insurance coverage charges after an accident until you’ve accident forgiveness. You possibly can count on your Allstate insurance coverage charges to extend by round 41% after an accident.

You need to use our free quote instrument beneath to immediately evaluate charges from the perfect firms close to you in case your Allstate charges went up after a wreck.

Do I’ve to pay a deductible if I used to be not at fault with Allstate?

Whilst you could must pay a deductible initially, Allstate will often get reimbursement from the at-fault celebration’s insurance coverage to assist cowl the prices. Nevertheless, test with an Allstate agent for specifics.

Discover out extra particulars in our complete information titled, “Auto Insurance coverage Deductible: Merely Defined.”

Why do insurance coverage firms drag out claims?

Usually, you might even see insurance coverage claims go on longer than anticipated so your insurer can confirm info or examine additional. Nevertheless, delays can be a tactic to persuade policyholders to just accept decrease payouts.

What’s the Allstate residence claims cellphone quantity?

To file a house insurance coverage declare with Allstate, merely name 1-800-255-7828.

Evaluate over 200 auto insurance coverage firms directly!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance coverage Agent

Heidi works with top-rated insurance coverage carriers to convey her shoppers the best high quality safety on the best costs. She based NoPhysicalTermLife.com, specializing in life insurance coverage that doesn’t require a medical examination. Heidi is an everyday contributor to a number of insurance coverage web sites, together with FinanceBuzz.com, Insurist.com, and Forbes.

As a mum or dad herself, she understands the necessity …

Editorial Tips: We’re a free on-line useful resource for anybody inquisitive about studying extra about auto insurance coverage. Our objective is to be an goal, third-party useful resource for every part auto insurance coverage associated. We replace our website repeatedly, and all content material is reviewed by auto insurance coverage consultants.

[ad_2]